Cryptocurrency: Understanding Digital Money and Investment Opportunities

Introduction:

cryptocurrency have revolutionized the way we think about money and transactions. Unlike traditional currencies controlled by governments, cryptocurrencies are decentralized digital assets that use blockchain technology to ensure security and transparency. Since the introduction of Bitcoin in 2009, cryptocurrencies have gained immense popularity, becoming an investment option and a method for global transactions. In this article, we will explore what makes cryptocurrencies unique, how they work, and the investment opportunities they offer.

1. What Makes Cryptocurrency Different from Traditional Currencies?

Cryptocurrencies differ from traditional currencies, often referred to as fiat money, in several key ways. While fiat money is issued and regulated by governments, cryptocurrencies operate independently of central authorities. This decentralization provides several benefits:

- Transparency and Security: Every transaction made with cryptocurrency is recorded on a public ledger called a blockchain, making it nearly impossible to alter or counterfeit.

- Ease of Transfer: Transactions can be completed quickly and at lower fees than traditional bank transfers, even across borders.

- Ownership Control: Users have full control over their assets without the need for intermediaries, like banks.

These differences have made cryptocurrencies attractive not only for personal use but also for businesses looking to streamline transactions and cut costs.

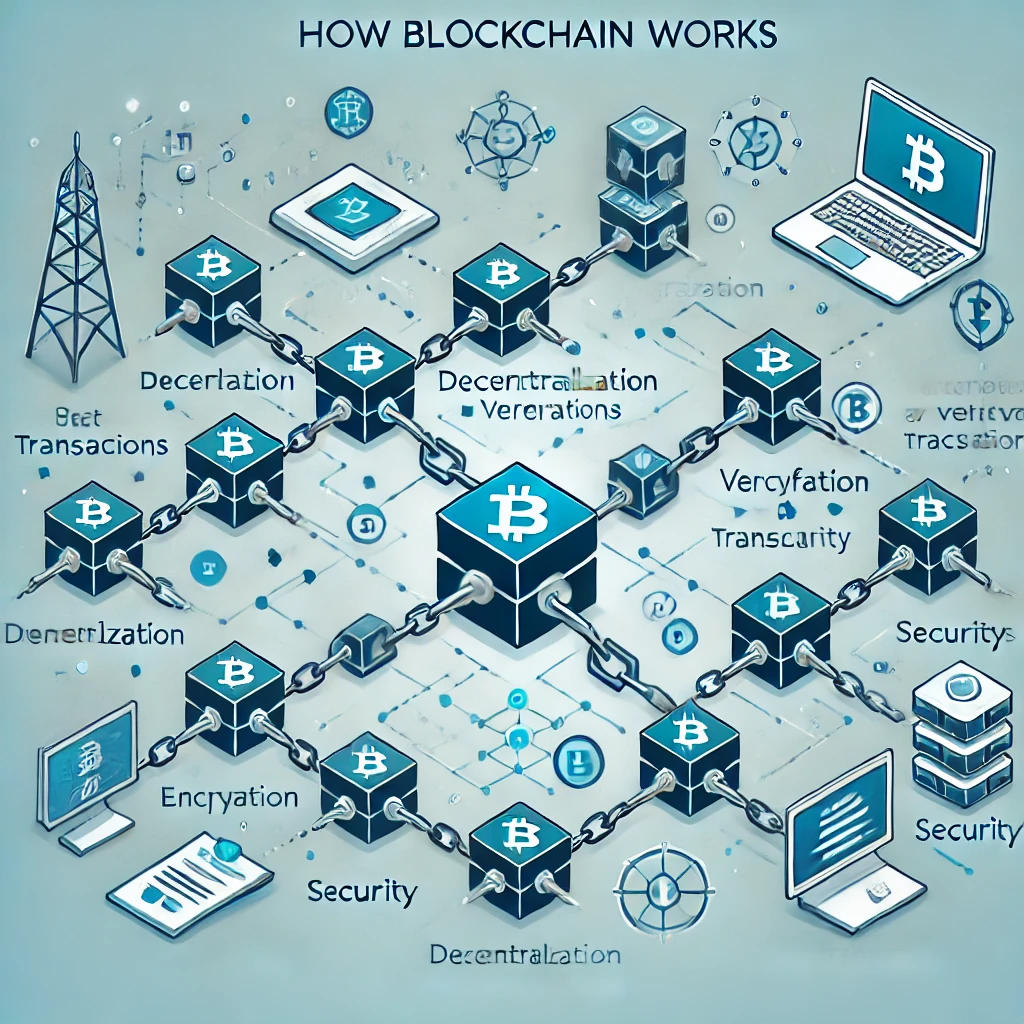

2. How Blockchain Works

The backbone of cryptocurrency is blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers. Here’s how it works:

- Transaction Recording: When a transaction is made, it gets grouped into a “block” with other transactions. This block is added to the chain of previous transactions, creating a continuous, unalterable history of transfers.

- Decentralization: Unlike traditional ledgers kept by banks, a blockchain is maintained by a network of computers (nodes) spread across the world. This ensures that no single entity has control over the network.

- Verification and Security: Each transaction must be verified by the network through a process called mining (for some cryptocurrencies) or consensus mechanisms. This verification ensures the integrity of the data.

3. Popular Types of Cryptocurrencies

There are thousands of cryptocurrencies, but a few have gained significant attention due to their unique features and widespread use:

- Bitcoin: The first and most well-known cryptocurrency. Bitcoin is often seen as digital gold and has become a store of value for many investors.

- Ethereum: While Bitcoin focuses on transactions, Ethereum is a platform that allows developers to build decentralized applications (DApps) using smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

- Litecoin, Ripple, and Others: Each of these cryptocurrencies offers different advantages. For example, Litecoin focuses on faster transaction times, while Ripple is known for facilitating cross-border payments.

4. Investment Opportunities in Cryptocurrencies

One of the reasons for the widespread interest in cryptocurrencies is their potential as an investment. Unlike traditional stocks and bonds, cryptocurrencies are highly volatile, providing opportunities for significant gains (and losses):

- Diverse Investment Options: Investors can choose from a range of cryptocurrencies, each with its own strengths. Some prefer the stability of Bitcoin, while others may invest in newer, emerging coins for potentially higher returns.

- High Returns Potential: Many early investors in cryptocurrencies like Bitcoin and Ethereum have seen substantial returns on their investments.

- Risks to Consider: While the potential rewards are high, the market is also highly volatile, and prices can fluctuate drastically within short periods. It’s crucial for investors to research and understand the risks before investing.

5. How to Invest in Cryptocurrencies Safely

Investing in cryptocurrencies can be straightforward, but safety is paramount:

- Choose Reputable Exchanges: Platforms like Binance, Coinbase, and Kraken are popular for buying and trading cryptocurrencies. Ensure the platform you choose has robust security measures.

- Set Up a Secure Wallet: Cryptocurrencies are stored in digital wallets. Hardware wallets (like Ledger and Trezor) are considered the safest because they are offline, reducing the risk of hacks.

- Protect Your Private Keys: Your private key is the password to your wallet. Keep it secure and never share it with anyone. Losing your private key could mean losing access to your funds forever.

6. The Future of Cryptocurrencies

The future of cryptocurrencies is promising but still uncertain. Several trends are shaping the industry:

- Regulation Changes: Governments worldwide are beginning to regulate cryptocurrencies to prevent illegal activities and protect investors. These regulations can have a significant impact on the market.

- Emerging Technologies: Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) are two innovations built on blockchain technology. DeFi aims to offer financial services without intermediaries, while NFTs allow ownership of digital assets like art, music, and more.

- Growth Potential: As more industries adopt blockchain technology, cryptocurrencies may continue to grow. Companies like Tesla and PayPal accepting Bitcoin for payments is a sign of wider adoption.

Conclusion:

Cryptocurrencies have changed the financial landscape, offering new ways to transact and invest. While they provide opportunities for profit, they also come with risks that require careful consideration. By understanding how cryptocurrencies work and the technology behind them, investors can make informed decisions about entering this exciting market. For those new to the world of digital assets, starting with thorough research and choosing a reliable platform is essential. Cryptocurrencies are here to stay, and their future promises even more innovations and possibilities.

Read More Articles